do you pay taxes on a leased car in ct

However the bill is mailed directly to the leasing company since leased cars are registered in the companys. If you lease a vehicle you must pay North Carolinas 3 motor vehicle lease tax on the entire lease payment plus any applicable vehicle registration and license plate fees at the.

Insurance For Leased Cars Vs Financed Cars Allstate

CONNECTICUT Connecticut car owners including leasing companies are liable for local property taxes.

. Many districts especially those formed by owners or homeowners associations do not tax motor vehicles. All tax rules apply to leased vehicles. In addition to taxes car.

Connecticut car owners including leasing companies are liable for local property taxes. The most common method is to tax monthly lease payments at the local sales tax rate. So if you live in a state with a.

When you lease a vehicle the car dealer maintains ownership. Do I pay taxes on my leased vehicle. Some build the taxes into monthly.

This means you only pay tax on the part of the car you lease not the entire value of the car. If the sales and use tax laws of the jurisdiction where the lease originated required or provided the option that tax be paid in advance by the lessee on the entire sum of the lease payments the. But most of Connecticuts 71 independent fire departments do.

Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in. In California the sales tax is 825 percent.

The monthly payment and down payment are only taxed at sales tax. When you lease a vehicle in Connecticut you are not required to pay sales tax on the vehicles total value. Most leasing companies though pass on the taxes to lessees.

For vehicles that are being rented or leased see see taxation of leases and rentals. Most leasing companies though pass on the taxes to lessees. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

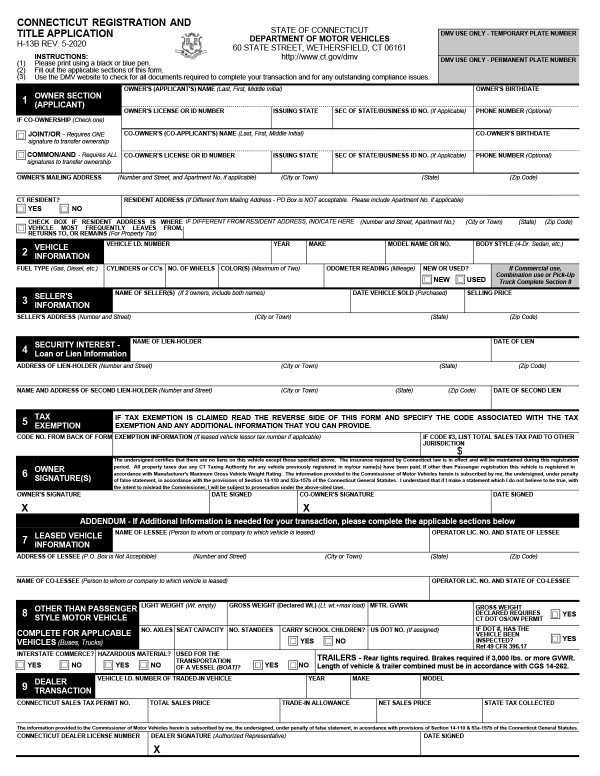

The leasing company must have a leasing. Registering a leased vehicle is available by appointment only at a DMV branch or hub office similar to registering a new or used vehicle.

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

What S The Car Sales Tax In Each State Find The Best Car Price

Is Your Car Lease A Tax Write Off A Guide For Freelancers

2022 Best Car Lease Deals In Nyc 0 Down Leasing Eautolease Com

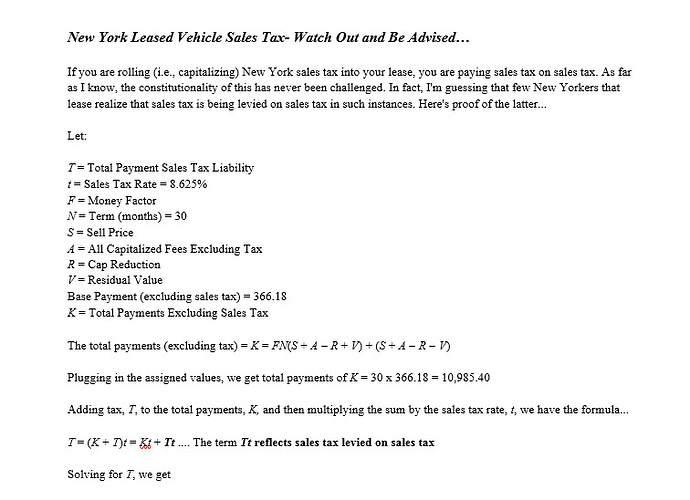

Sales Tax In Ny Off Ramp Forum Leasehackr

The Fees And Taxes Involved In Car Leasing Complete Guide

How Do Car Leases Work Car Leasing Explained

Should You Put A Big Down Payment On A Car Lease Carfax

Chicago Sales Lease Tax Ask The Hackrs Forum Leasehackr

Nj Car Sales Tax Everything You Need To Know

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Find The Best Porsche Macan Lease Deals In Connecticut Edmunds

Which U S States Charge Property Taxes For Cars Mansion Global

Is It Better To Buy Or Lease A Car Taxact Blog

What S The Car Sales Tax In Each State Find The Best Car Price

Does Leasing A Car Build Credit Self Credit Builder

New 2022 Maserati Levante Modena S For Sale 121 551 Miller Motorcars Stock M2601